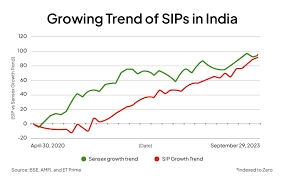

Mumbai: Retail investor enthusiasm for systematic investment plans (SIPs) in India has reached a new high, with monthly flows hitting ₹29,361 crore in September and a full-year tally crossing ₹2.63 lakh crore, marking a growth of over 32 percent compared with the previous year.

Industry data shows that the number of folios under SIPs has now exceeded 25 crore, highlighting the growing penetration of mutual funds among Indian households.

Rising Confidence in Mutual Funds

The sustained inflows signal increasing confidence among retail investors in equity-oriented mutual funds, even amid market volatility. With SIP assets now accounting for about 19 percent of total mutual-fund industry assets, this segment is becoming a key pillar of India’s broader investment ecosystem.

The trend is likely to prompt mutual-fund houses, financial advisers, and fintech platforms to ramp up marketing, diversify product offerings, and enhance investor-education efforts to capture the growing interest.

What’s Driving the Surge

Several factors underpin this strong growth:

- A long-term mindset among retail investors who continue systematic contributions despite market swings.

- Expanded product choices such as flexi-cap, mid-cap, and small-cap funds that allow investors to tailor their risk appetite.

- Growing reach of mutual funds beyond metros, aided by digital onboarding, awareness campaigns, and advisory networks.

Implications and Risks

The increase in SIP flows could lead to higher liquidity and broader participation in equities, potentially boosting valuations and market depth. However, as newer and less-experienced investors join, it becomes vital to strengthen investor protection and ensure adequate financial literacy.

A sustained focus on equities may leave some portfolios exposed during market corrections, making diversification critical. Fund houses will need to maintain transparency in expense ratios and performance to sustain trust.

Looking Ahead

If new folios continue to grow and assets under management expand at the current pace, SIPs could soon become the dominant channel for mutual-fund investments in India.

Financial advisers and digital wealth platforms are expected to capitalize on this momentum with goal-based investing tools and personalized SIP plans. Regulators and industry bodies may also step up investor-education initiatives to maintain responsible investing practices as participation deepens.